- #Iso 8583 response code list registration

- #Iso 8583 response code list iso

- #Iso 8583 response code list series

ISO 8583 messaging has no routing information, so is sometimes used with a TPDU header.Ĭardholder-originated transactions include purchase, withdrawal, deposit, refund, reversal, balance inquiry, payments and inter-account transfers.

As of June 2017, however ISO 8583:2003 has yet to achieve wide acceptance.

The placements of fields in different versions of the standard varies for example, the currency elements of the 19 versions of the standard are no longer used in the 2003 version, which holds currency as a sub-element of any financial amount element.

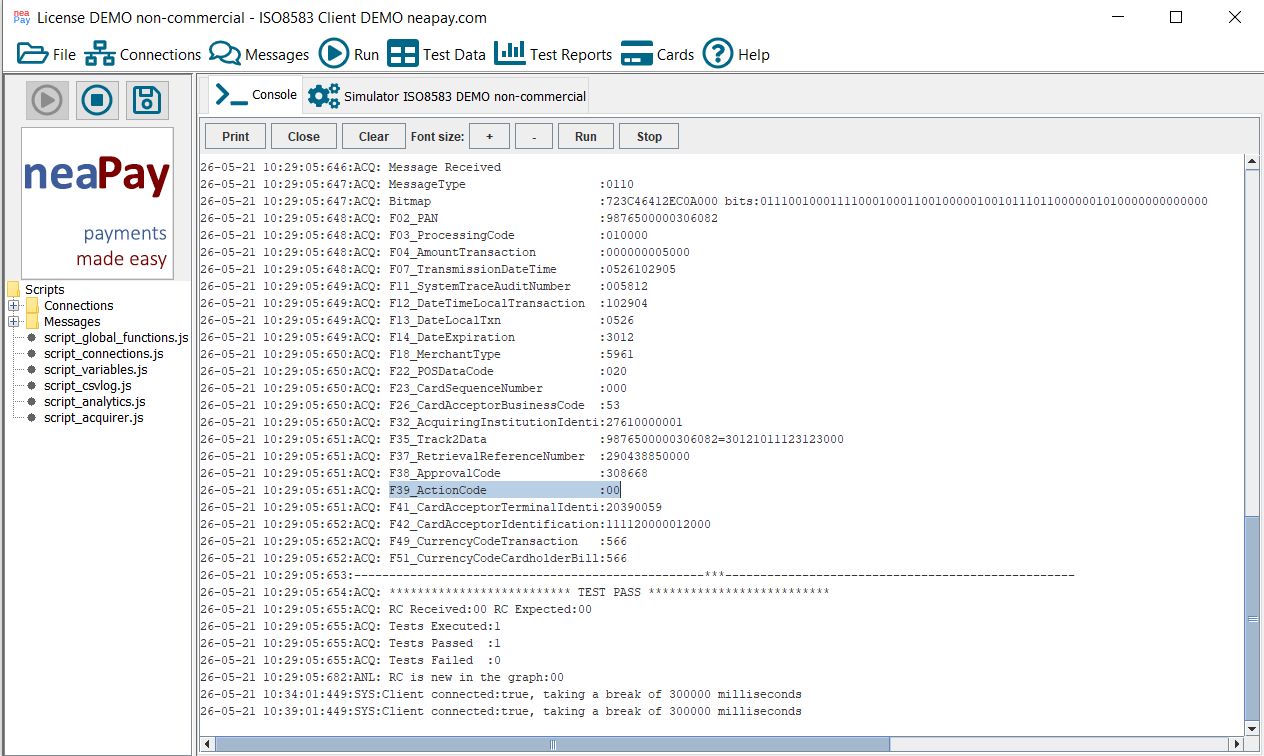

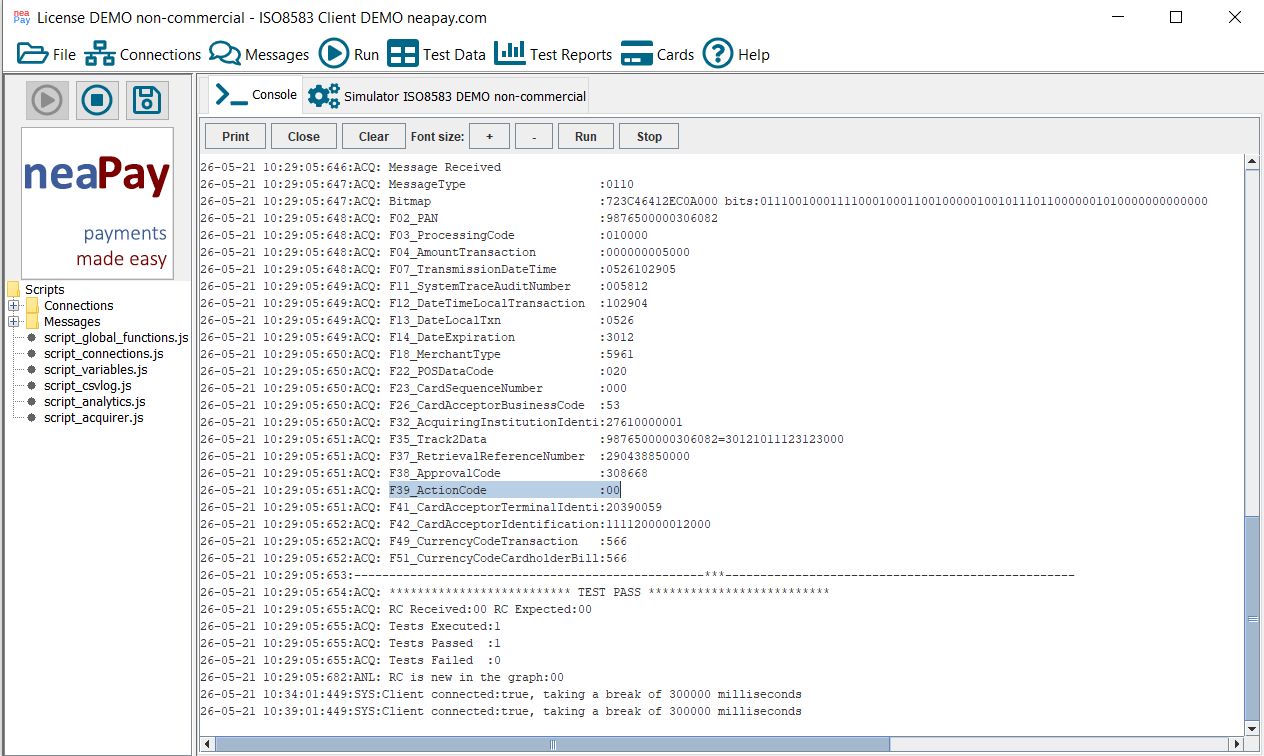

Data elements, the actual information fields of the message. One or more bitmaps, indicating which data elements are present. Based on this information, the card issuing system will either authorize or decline the transaction and generate a response message which must be delivered back to the terminal within a predefined time period.Īn ISO 8583 message is made of the following parts: The transaction data contains information derived from the card (e.g., the card number or card holder details), the terminal (e.g., the terminal number, the merchant number), the transaction (e.g., the amount), together with other data which may be generated dynamically or added by intervening systems. #Iso 8583 response code list series

Part 3: Maintenance procedures for the aforementioned messages, data elements and code values Ī card-based transaction typically travels from a transaction-acquiring device, such as a point-of-sale terminal or an automated teller machine (ATM), through a series of networks, to a card issuing system for authorization against the card holder's account.

#Iso 8583 response code list registration

Part 2: Application and registration procedures for Institution Identification Codes (IIC). Part 1: Messages, data elements, and code values. The ISO 8583 specification has three parts: 2.3.2 ISO-defined data elements (ver 1987). These fields are used by each network to adapt the standard for its own use with custom fields and custom usages. It defines many standard fields (data elements) which remain the same in all systems or networks, and leaves a few additional fields for passing network-specific details. In particular, the Mastercard, Visa and Verve networks base their authorization communications on the ISO 8583 standard, as do many other institutions and networks.Īlthough ISO 8583 defines a common standard, it is not typically used directly by systems or networks. The vast majority of transactions made when a customer uses a card to make a payment in a store ( EFTPOS) use ISO 8583 at some point in the communication chain, as do transactions made at ATMs. ISO 8583 defines a message format and a communication flow so that different systems can exchange these transaction requests and responses. It is the International Organization for Standardization standard for systems that exchange electronic transactions initiated by cardholders using payment cards. ' ISO 8583' is an international standard for financial transaction card originated interchange messaging. ( Learn how and when to remove this template message) JSTOR ( February 2011) ( Learn how and when to remove this template message). Unsourced material may be challenged and removed. Please help improve this article by adding citations to reliable sources. This article needs additional citations for verification.

0 kommentar(er)

0 kommentar(er)